This is something I am always banging about in my line of work. Many of your customers will prefer to do business on credit and most will likely insist that you extend credit terms. Under the best of circumstances, it’s unlikely that they’ll all pay on time.

By establishing and enforcing smart credit policies your business will run more smoothly and maintain a sufficient cash flow.

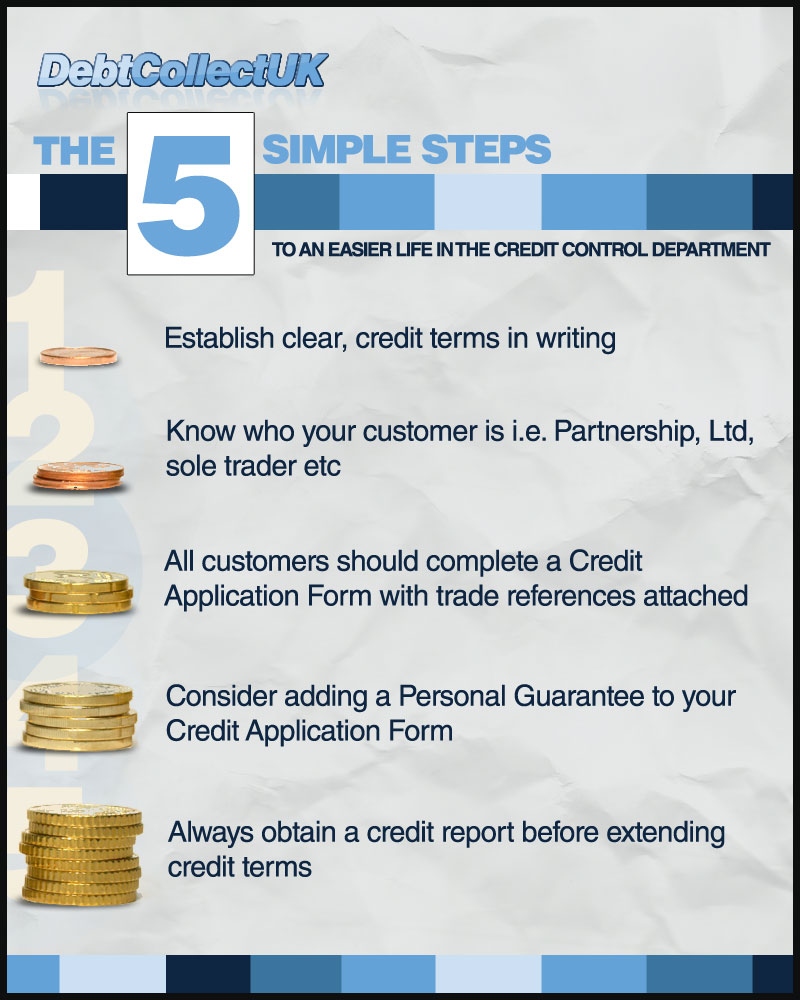

Follow the 5 simple steps below and you will find life easier in the credit control department

Further explanations of the credit control rules:

Step 1 – Although no policy is foolproof, write a set of credit terms based on what works for your business. If you are diligent and thorough the policy should serve you well.

Step 2 – Your customer must make it clear what their legal entity is. There is a big difference to giving credit to a sole trader to an Ltd company.

Step 3 – don’t just read the trade references. Always check the trade references are legit. What is the point of asking for trade references if you don’t check them? Also beware of customers who won’t complete a Credit Application Form. Are they hiding something?

Step 4 – by adding a Personal Guarantee you are giving your business additional protection should the customer’s business go under.

Step 5 – Has your customer got a good history of paying on time? You will soon know by checking their transactions in the last 6 months.

Always monitor your customers and credit terms on an ongoing basis. Instinct is something I believe in. If a customer is new and you have a bad feeling they might leave you with bad debt, only accept cash or Cash on Delivery. Never under estimate your gut feeling. A customer is only a customer who pays. If they don’t pay you will be left with more than a headache